. . . and why it doesn’t receive the R&D funding that it should

A new Midlands Engine Insights report finds that the scale and economic contribution of the region’s aerospace cluster is considerably greater than stated by current statistics used by policy makers.

The report, co-authored by Midlands Engine Observatory (MEO) and Midlands Aerospace Alliance (MAA), also finds that the cluster needs to be much better understood to establish where research and development funding should be most effectively allocated.

Quantifying the size of aerospace in the Midlands

The Midlands is home to a major aerospace cluster, including global players Collins Aerospace, ITP Aero UK, Moog Aircraft Group, Parker-Meggitt and Rolls-Royce, along with an extensive network of supply chain companies and R&D assets.

Official statistics suggest the Midlands has around 20,000 aerospace jobs across 225 sites. Policy makers know this data, based on Standard Industrial Classification codes, is often very inaccurate because of the way companies are categorised, but there is usually little better information.

Using a comprehensive company dataset collected from the bottom-up – an approach that’s believed to be the first of its kind in the UK – the MAA and MEO have calculated that these numbers are much higher with:

- 524 individual firms

- 36,500 employees

- 595 sites in the region

The Midlands’ aerospace supply chain in a national context is therefore much more significant than previously thought, covering over 20% of UK aerospace sites – up from 10% as previous data would indicate.

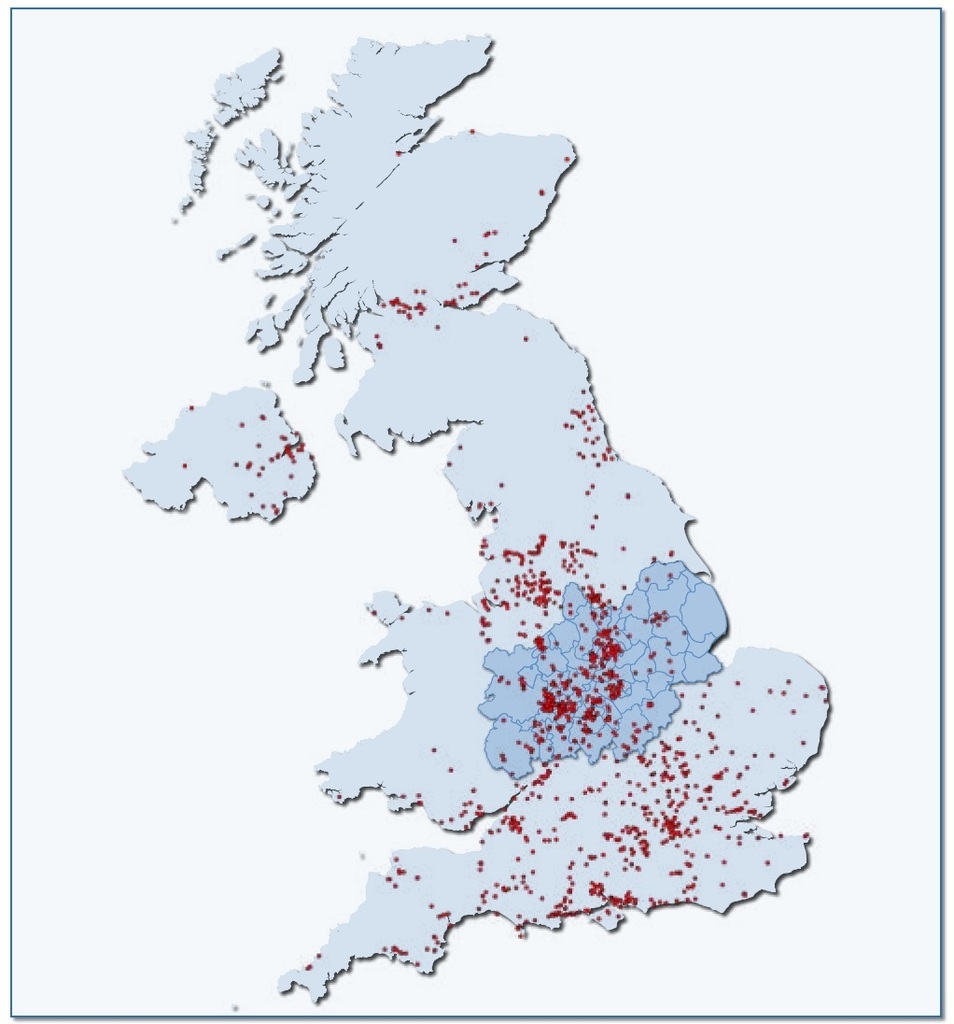

The Midlands is home to 21% of the most specialist UK aerospace companies, those with the demanding “AS9100” accreditation that permits them to make ‘flying parts’ of aircraft (map below).

A cluster that generates £5.3bn in GVA

Further analysis suggests that the most technically specialist Midlands aerospace companies generate over £3.5bn Gross Value Added (GVA) for the Midlands economy.

After adding in regional economic multiplier effects generated by company and employee spend, over 100,000 Midlands jobs and £5.3bn GVA are created by the revenue brought into the region by Midlands business success in global aerospace markets.

Quantifying aerospace R&D grant funding to Midlands businesses

Aerospace companies around the world are focused on developing new technologies that can reduce the environmental impact of aviation. National governments invest substantial R&D funding to support this effort and grow their aerospace sectors.

The report also analysed how much R&D funding was invested by government in Midlands aerospace businesses. It found that:

- Companies and research bodies in the Midlands were awarded £763m in national, European and regional aerospace R&D grants between 2013/14 and 2021/22

- UK national funding has been by far the largest source of support, driven by awards from the UK’s Aerospace Technology Institute (ATI)

- ATI programmes awarded £655m to Midlands organisations between 2013 and 2022 - 41% of all ATI funding and significantly more than any other region

Unbalanced allocation of R&D funding in Midlands aerospace

While this suggests Midlands aerospace has benefited greatly from national R&D grants, the funding is highly concentrated in large companies and universities. Aero-engine maker Rolls-Royce is the main recipient, receiving 75% of all grants, and 91% of all grants awarded to industry.

The report’s new dataset, in contrast, finds that:

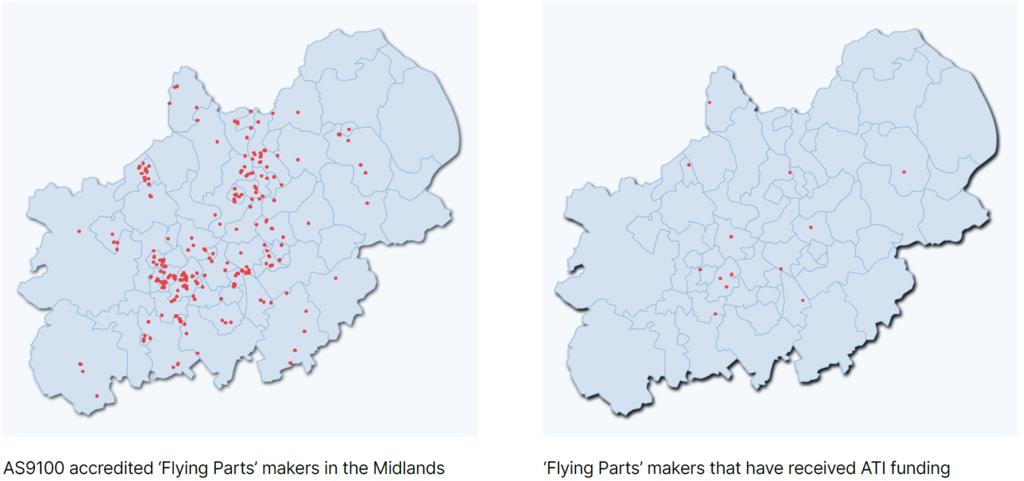

- AS9100-accredited 'flying parts' companies which account for one-third of the specialist aerospace jobs in the Midlands have received less than 1% of the R&D grants

- 94% of these companies have not received any R&D grants from the ATI or other parts of the national aerospace R&D ecosystem (map below).

The report asks whether this skewed distribution may suggest a level of untapped innovation potential in the regional aerospace cluster.

The data reveals that government R&D grants are highly concentrated. It will be important to understand why this is the case, whether investing in R&D grants for aerospace supply chain companies might increase the cluster’s regional impact and opportunity to contribute to a more sustainable aviation industry, and if so, how to implement any policy change in collaboration with the ATI, MAA, government and industry itself.

The MAA and MEO are now using the comprehensive data and findings from this project as a foundation for wider research and projects.

Access the report

To access the full 12 page report (free) click here.

To see the one-page factsheet click on the image below.